Innovation and Balanced Innovation Composites

Product Description

The Moloney Securities Innovation and Balanced Innovation Composites, managed by Ron Medley, are available to individual and institutional investors and can be customized to meet the needs of each client's investment policy.

Strategy Overview

The MSAM Innovation strategies seek to target wealth creation through allocating capital to the ideas of tomorrow in a risk managed way.

The investment research process is focused on areas where returns to society are greatest. Whether reviewing the evolution automobiles and transportation over the last century or the information revolution of big data and artificial intelligence in more recent times, pervasive change provides opportunity for capital investment and wealth creation at scale. For example, even during the pandemic, innovation continued:

Source: IFI Claims Patent Services

Strategies:

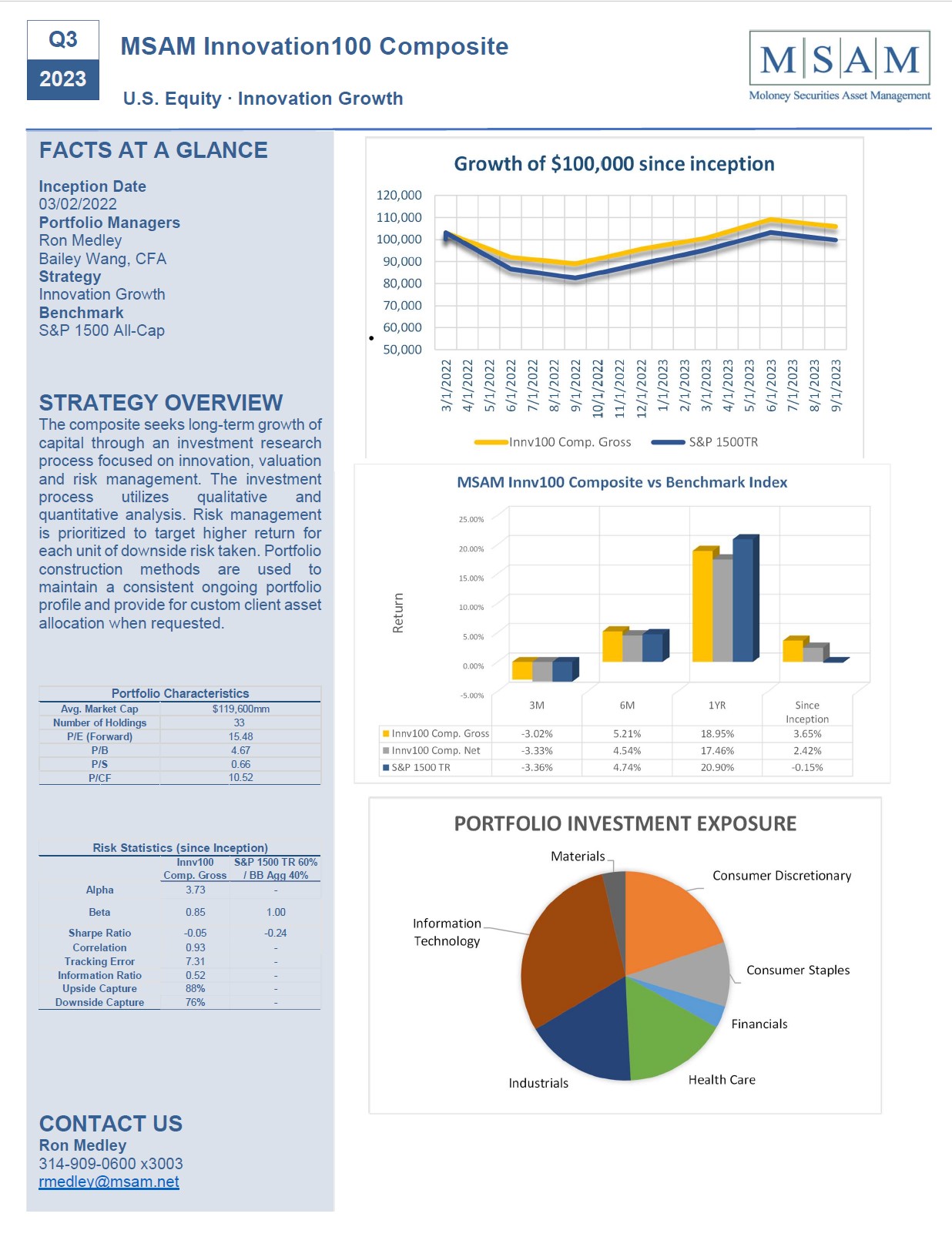

Innovation 100 (targets all equities with no fixed component):

The composite seeks long-term growth of capital through an investment research process focused on innovation, valuation and risk management. The investment process utilizes qualitative and quantitative analysis. Risk management is prioritized to target higher return for each unit of downside risk taken. Portfolio construction methods are used to manage risk, maintain a consistent ongoing portfolio profile and provide for custom client asset allocation when requested.

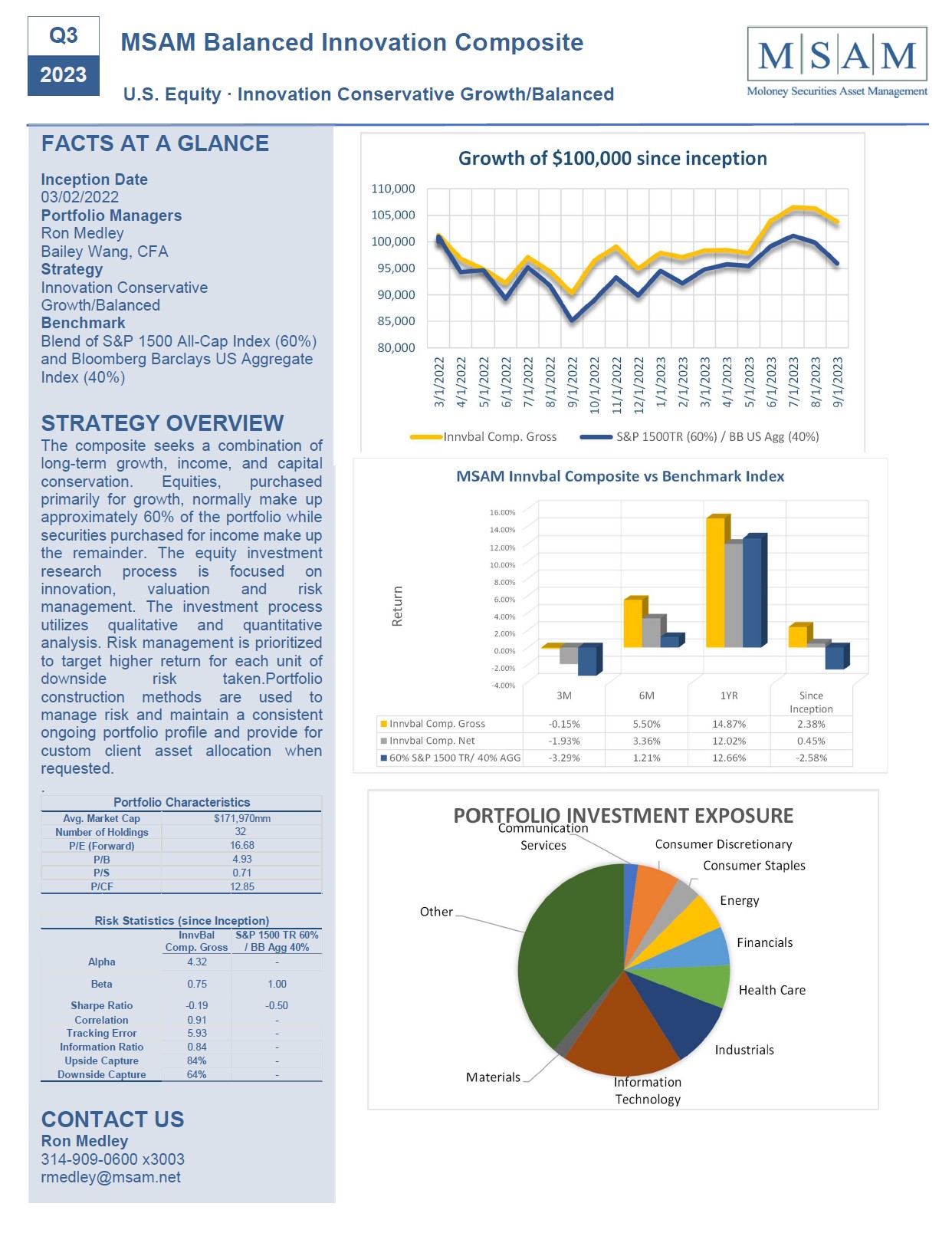

Balanced Innovation (60/40 equity/fixed blend):

The composite seeks a combination of long-term growth, income, and capital conservation. Equities, purchased primarily for growth, normally make up approximately 60% of the portfolio while securities purchased for income make up the remainder. The equity investment research process is focused on innovation, valuation and risk management. The investment process utilizes qualitative and quantitative analysis. Risk management is prioritized to target higher return for each unit of downside risk taken. Portfolio construction methods are used to manage risk, maintain a consistent ongoing portfolio profile and provide for custom client asset allocation when requested.

Client Customization

The investment strategy can be further customized to meet the needs of each individual client's investment policy. This is accomplished by narrowing the investment style to meet each client's investment preferences.

Disclosures:

- Moloney Securities Asset Management (MSAM) is a SEC Registered Investment Advisor, owned by Briar Green Holdings LLC, and an affiliate of Moloney Securities Co., Inc., a broker/dealer. Securities are transacted through Moloney Securities Co., Inc unless instructed by the client otherwise.

- Past performance is not indicative of future results. Investment following an MSAM recommended strategy may result in capital loss. Return calculations for the MSAM composites are time-weighted using market closing prices.

- Supplemental graph showing growth of $100,000 is for illustrative purposes only. No contributions or withdrawals are contemplated. No taxes or investment management fees are considered. The statistics are based on annual returns assuming reinvestment of dividends and income, and account for both realized and unrealized gains and losses.

- The MSAM Innovation100 Composite contains discretionary, fee-paying accounts, managed by Ron Medley and Bailey Wang, CFA, that follow an innovation growth investment strategy. Investments can include both equity & income producing securities, but all investments are targeted to be 100% equities. Equity investments are sought in companies that display fundamental growth characteristics or exhibit characteristics that are expected to outperform in the long term. The investment research process targets innovation, valuation and risk management. Income producing securities can be used and are generally considered to lessen the volatility of the whole portfolio. Since inception date, the average allocation to income producing securities is under 10%. Account asset allocations are adjusted individually in accordance with each client's risk tolerance & investment preferences. Risk management is prioritized to target higher return for each unit of downside risk taken. Portfolio construction methods are used to manage risk, maintain a consistent ongoing portfolio profile and provide for custom client asset allocation when requested.

- The MSAM Balanced Innovation Composite contains discretionary, fee-paying accounts, managed by Ron Medley and Bailey Wang, CFA, that follow an innovation growth investment strategy. Investments can include both equity & income producing securities. Investments are targeted to be 60% equities/40% fixed income. Equity investments are sought in companies that display fundamental growth characteristics or exhibit characteristics that are expected to outperform in the long term. The investment research process targets innovation, valuation and risk management. Income producing securities can be used and are generally considered to lessen the volatility of the whole portfolio. Since inception date, the average allocation to income producing securities is 40%. Account asset allocations are adjusted individually in accordance with each client's risk tolerance & investment preferences. Risk management is prioritized to target higher return for each unit of downside risk taken. Portfolio construction methods are used to manage risk, maintain a consistent ongoing portfolio profile and provide for custom client asset allocation when requested.

- Returns are presented both gross and net of management fees and include the reinvestment of all income. Gross of fees includes trading costs and net of fees includes management fees. Net of fees is net of actual fees. There are no performance fees. All performance is in USD. The effect of withholding tax on the composite is not considered nor is it reflected in the benchmark price indices. The firm has a policy of checking for significant cash flows and revaluing portfolios for performance purposes when a cash flow greater than 10% happens. The fee schedule is negotiable with the highest potential fee of 2% of assets under management in the composite.

- To receive a complete list, description and presentation of all MSAM composites, policies regarding valuing portfolios, calculating performance and/or additional presentation information, contact Ron Medley at 1-800-628-6002, x3003 or write Attn: Ron Medley, MSAM, 13537 Barrett Pkwy. Dr., Ste. 330, Manchester, MO, 63021.